Donations to SMU are eligible for 2.5x tax deductions

Did you know that donations to SMU are eligible for 2.5x tax deductions?

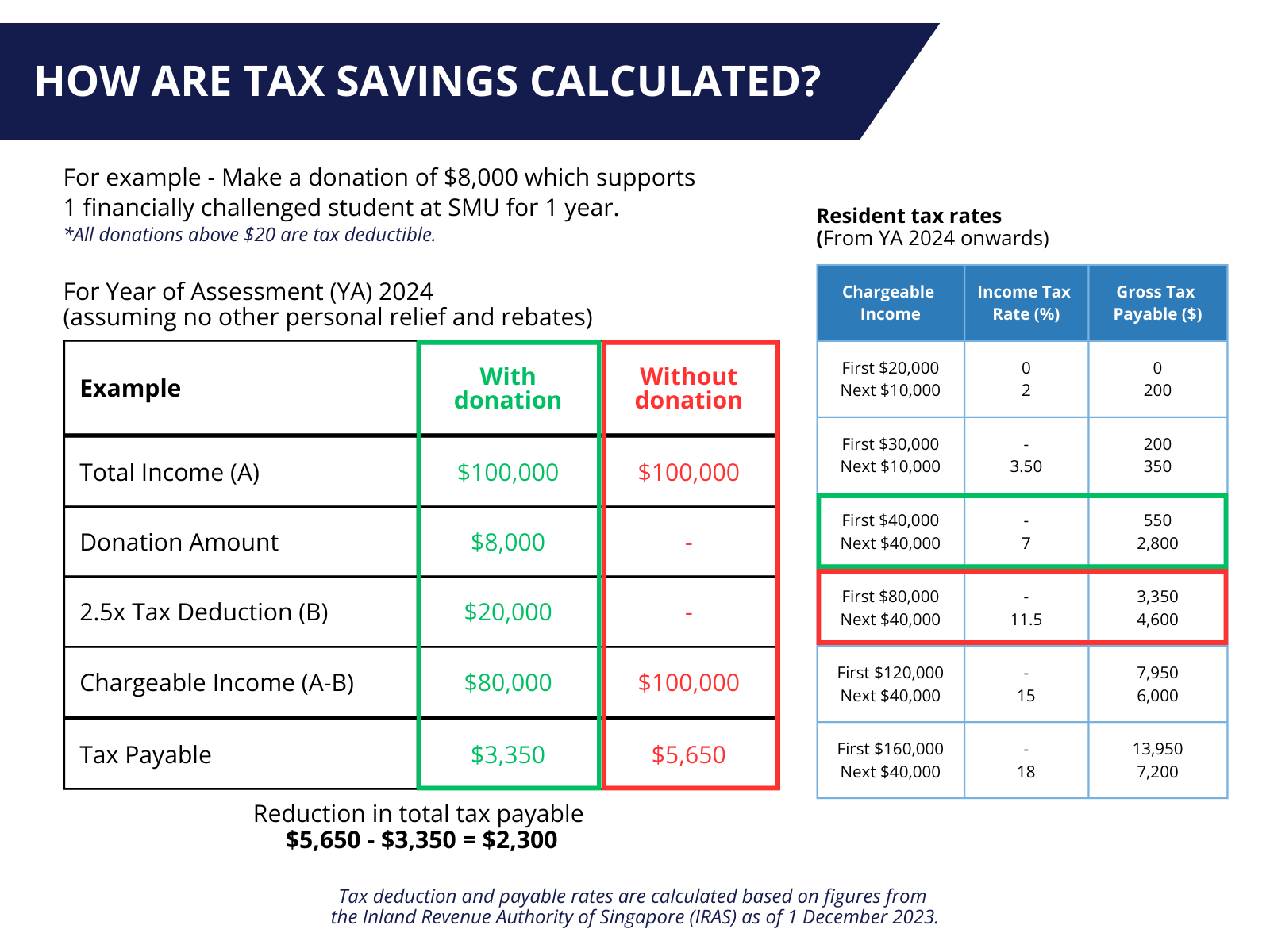

Why not consider doing good whilst enjoying tax savings during this season of giving? Your contributions will not only empower and inspire financially challenged students, but also help you – or your company – to reduce your taxable income by 2.5 times of the donated amount.

Here's an example on how donations may lower your tax bracket:

Your donation is 2.5x tax deductible if:

- You are a Singapore tax resident

- Your tax reference number (NRIC/FIN/UEN) is provided when making the donation.

SMU will submit your donation records to IRAS electronically and the deduction will be automatically included in your tax assessment. IRAS no longer accepts claims for tax deductions based on donation receipts. - Your donation is a minimum of S$20

Plan your donation dates

If you are looking to receive the tax deduction for Year of Assessment 2024, do make your gift by 27 Dec 2023.

For SMU alumni, explore different giving opportunities under the Alumni Giving section. Or, plan ahead to maximise your giving impact whilst optimising your tax deductions by starting a conversation with us at alumnigiving@smu.edu.sg!

SMU has an approved Institution of a Public Character (IPC) status.

Donations made to a charity without approved IPC status are not tax deductible.